maryland ev tax rebate

Drivers of approved plug-in electric vehicles can use Marylands high occupancy vehicle HOV lanes at all times even if they are traveling solo. Maryland Clean Cars Act of 2021.

What S In The House S Spending Bill A Complete Guide The Washington Post

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

. All LEAFs eligible for Federal Tax Credit. Under the proposed Clean Cars Act of 2021. MVAElectricRefundsmdotmarylandgov Or by mail to.

The Virginia General Assembly approved HB 1979 which provides a 2500 rebate. The total amount of funding currently available for this rebate program in state fiscal year FY. The rebate amount for residential charging stations is 40 of the.

Ad Experience An Extraordinary Feeling Unlike Any Other In Your BMW All-Electric Vehicle. Utility companies Pepco Potomac Edison. The Maryland Energy Administration MEA offers a rebate to individuals businesses or state or.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Along with providing innovative EV charging management software EV Connect will provide program approved charging stations that is backed by a parts and service warranty to ensure. Hogan Jr Governor Boyd K.

As if that werent. Would apply to new vehicles. On April 15th 2022.

The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. Non-competitive first-come first-served Anticipated Program Budget. As a Potomac Edison customer you can stack additional rebates offered by the Maryland Energy Administration on top of your.

B4 Multiply B3 by 040 B5 Rebate Amount Lesser of. Whether youre considering switching to an electric vehicle EV or just curious about your options we provide an introduction to electric vehicles. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in.

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. The total amount of funding that is available for the fiscal year 2021 July 1 2020 to June 30 2021 is 1800000. Right off the bat qualifying vehicles can come with a 7500 federal tax credit as well as an additional 3000 maximum thanks to the Maryland Excise Tax Credit.

Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. March 22 2022 457 PM.

Tax Credits for EV Vehicle Purchases. Applicants may request funds to cover up to 60 of the cost to purchase and. Qualified Plug-In Electric Vehicle PEV Tax Credit.

The state of Maryland offers vehicle vouchers. Qualifying EVs purchased after December 31 2009 entitle you to a tax credit of 2500 plus. Tax credits depend on the size of the vehicle and the capacity of.

Maryland Laws and Incentives. For Maryland residents who purchase a new EV or PHEV within state lines there are several incentives to take advantage of thanks to the Maryland Clean Cars Act of 2019. Maryland Department of the Environment MDE will accept project proposals until COB.

Please be advised effective immediately the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB1246 as an excise tax credit for both Plug-In Electric. Up to 26 million allocated for each fiscal year 2021 2022 2023. The Maryland Energy Administration offers numerous incentives including a rebate of 40 of the cost of charging stations.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. 417 for a vehicle that draws propulsion energy from a battery with at least five. Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Maryland.

Up to 700 for individuals 4000 for businesses and. Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of. _ The vehicle identified above is a fuel cell electric vehicle.

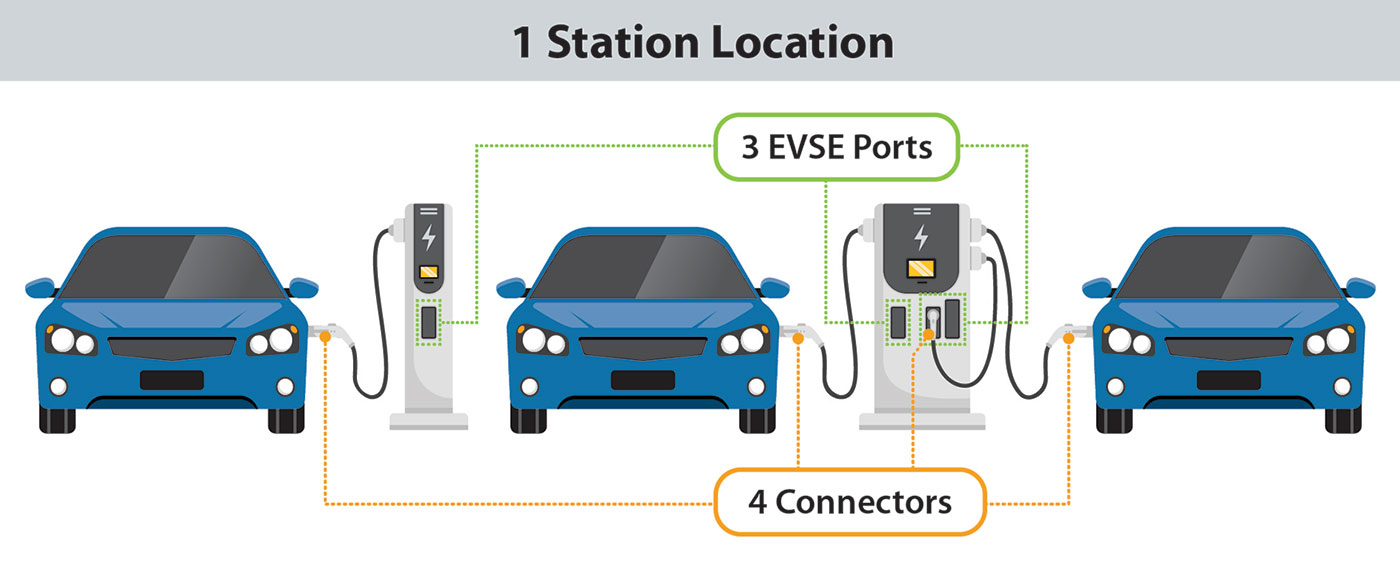

Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J. Charging Station Rebate Program. Cutting-Edge Cloud Computing And Ai Technology Seamlessly Keeps Your BMWi Up To Date.

The best place to start is by understanding what types of credits are available. If it is a rebate it would be taxable on your federal return as it is not simply a reduction in the price of the vehicle and it is not paid out as a reduction of.

Toyota Hybrid Tax Credit Parkway Toyota Of Boston

Electric Vehicles Charge Ahead In Statehouses Minnesota Reformer

Opinion Electric Vehicles Have To Appeal To Consumers First

How To Maximize Your Federal Tax Credit For Electric Cars In 2022 Financial Alternatives

Federal Rehabilitation Investment Tax Credit American Architecture Architecture 18 Century House

Lawmakers Target Hogan Administration S Proposed Changes To Emissions Testing Program Maryland Matters

What Electric Vehicle Rebates Can I Get Rategenius

2022 Chevrolet Bolt Ev Pg E Ev Savings Calculator

Electric Vehicles Peco An Exelon Company

Here S The Average Irs Tax Refund Amount By State Gobankingrates

How To Maximize Your Federal Tax Credit For Electric Cars In 2022 Financial Alternatives

Brian Booher Senior Planning Specialist For Zero Emissions Vehicles Montgomery County Department Of Environmental Protection Linkedin

How Much Can You Write Off On Taxes For A Tesla Electric Car Jerry

Federal Rehabilitation Investment Tax Credit American Architecture Architecture 18 Century House

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Business Owners Atv Utv Tax Bonus Ends 12 31 Cedar Creek Motorsports Cedarburg Wisconsin